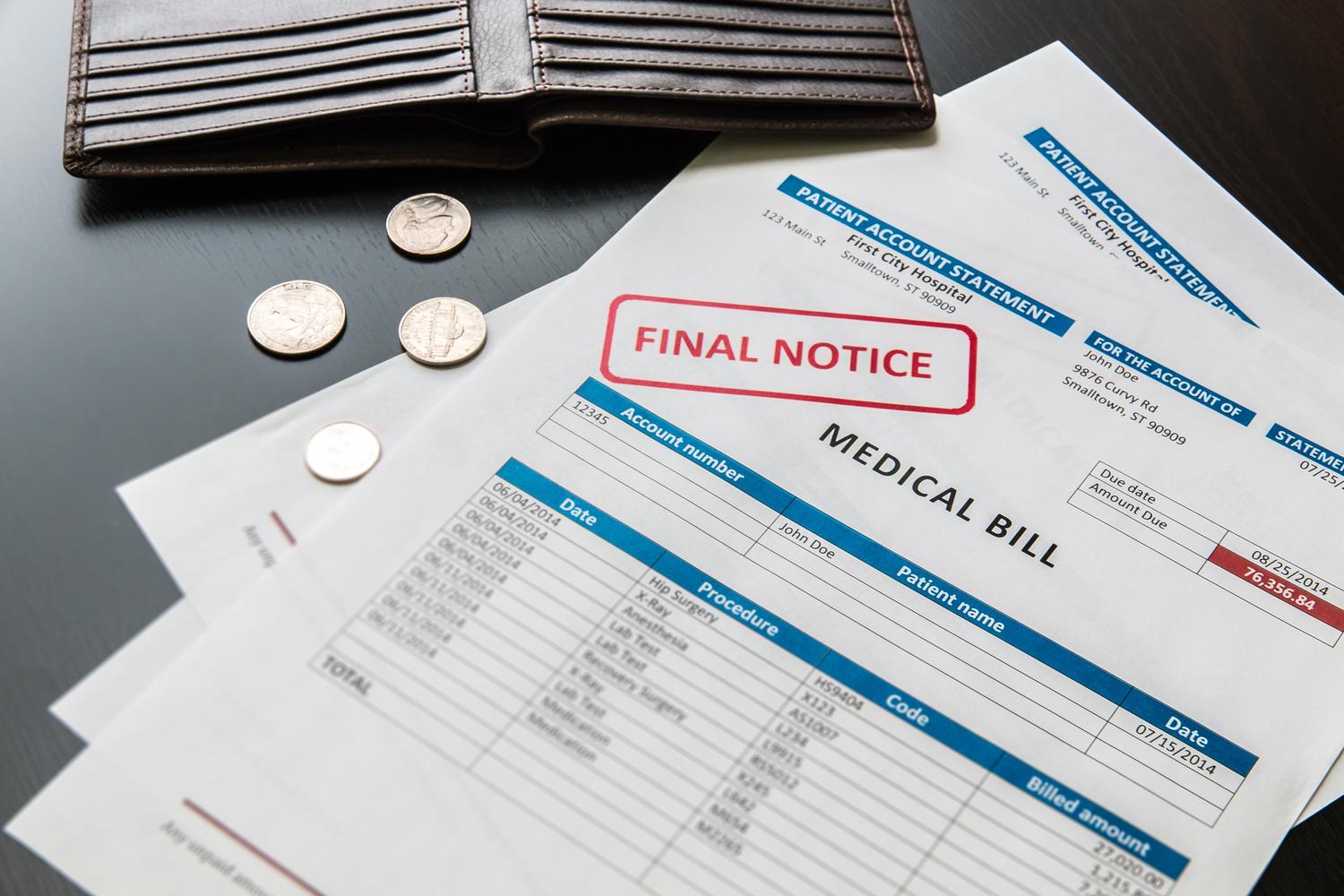

Medical Costs to Expect in Retirement

Expenses to expect in retirement & how to plan for them

The cost of health care is rising. A 2021 study by RBC Wealth Management projected the lifetime health care costs for a 65-year-old couple at just over $662,000. The same study showed that nearly 68% of a retiree’s Social Security benefits go toward these costs and that Medicare covers just a little more than half of health care expenses in retirement. As premiums and deductibles escalate, programs like Medicare and Social Security are increasingly unable to carry a significant portion of this financial burden.

There are several reasons for the mounting costs of health care expenses in retirement. People, on average, are living longer than they used to. This means that there is greater demand for products and services within health care systems. Additionally, many older people are opting for more “maintenance” procedures: operations such as joint replacement surgery and cataract surgery. These procedures, because they are often elective and not deemed medically “necessary” come with higher out-of-pocket costs, along with the rehabilitation and follow-up care that is required after the surgery is performed. People are also retiring, on average, at the age of 62 — 3 years before they are eligible for Medicare. This means that they may spend 3 years without employer or union-sponsored health benefits before they are able to access government-subsidized financial aid.

Most recently, the COVID-19 pandemic caused dramatic inflation in prices for goods and services across the board. Nearly every American has felt the impact of rising costs for groceries, gas, and home goods for the past few years. This inflation has also touched health care. Due to supply-chain and labor shortages, many medical products are more expensive than they used to be. This drives up the cost for the consumer who must pay for both health care services, and the equipment used for their treatment.

To help patients plan ahead and prepare for these health care costs, we sat down with our own Mike Botta, a former White House advisor who has spent over 15 years in health care leadership. He detailed several unforeseen health care costs that people experience as they age, and offered some suggestions to defray and minimize the expense to your personal bank account.

1) After age 65, the biggest financial concern for most people is the cost of long-term care. Long-term care is an umbrella term that describes home health assistance (like having a caregiver see you in your home), nursing homes, and assisted living facilities. There is a cost to these living arrangements, and in many cases, that cost is not fully covered by Medicare or Social Security benefits. According to a study by the California Health Care Foundation, nearly 6.5 million Californians will need to use long-term care services by 2025. Nearly 1 million of these people will be over the age of 85. Again, these services and facilities can be expensive. It’s important that you plan ahead to be able to manage the cost of assisted-living/ nursing homes, or home health assistance services. Enrolling in a health savings account (HSA) can help you set aside funds from your paycheck toward future medical expenses such as the types of long-term care listed above.

2) If you are enrolled in regular Medicare, you should know that the plan does not cover vision or dental care-related expenses. Vision care includes eye procedures, prescription lenses, and vision tests. Dental care includes crowns, tooth replacements, root canals, and dentures. These products and procedures become more common as you age, and these costs can add up. You may consider enrolling in the Medicare Advantage plan to help cover these expenses — as this plan offers coverage for vision and dental care.

3) Finally, prescription drugs can have high sticker prices. These have come down through federal programs like Medicare Part D and new negotiation rules, but many seniors still find them unaffordable, particularly for newer, brand-name drugs. Opting for the generic version of these drugs (such as methylprednisolone instead of the brand name Medrol) can often save consumers hundreds of dollars on their prescription medication. In addition, receiving larger supplies of medication (when available) and home delivery can help minimize transportation costs and refill expenses throughout the year. These are small steps, but they can help chip away at exorbitant medical costs that pile up as you age.

In sum, we at Sesame highly recommend that you start planning ahead. One of the most common mistakes people make, according to Mike Botta, is thinking that Medicare will cover the entirety of their medical expenses once they retire. That is not the case. Start setting aside some of your income and financially preparing for life as you age. A retirement budget can be massively helpful in a number of ways for people looking ahead to a time in their life when they are no longer gainfully employed. Include health care expenses into this budget to avoid any surprises or unplanned costs that put stress on you or your wallet. You should spend this time of your life focusing on things you want to do, trips you want to take, and enjoying your free time, not worrying about your medical bills!